- Why [24]7.ai

- Products

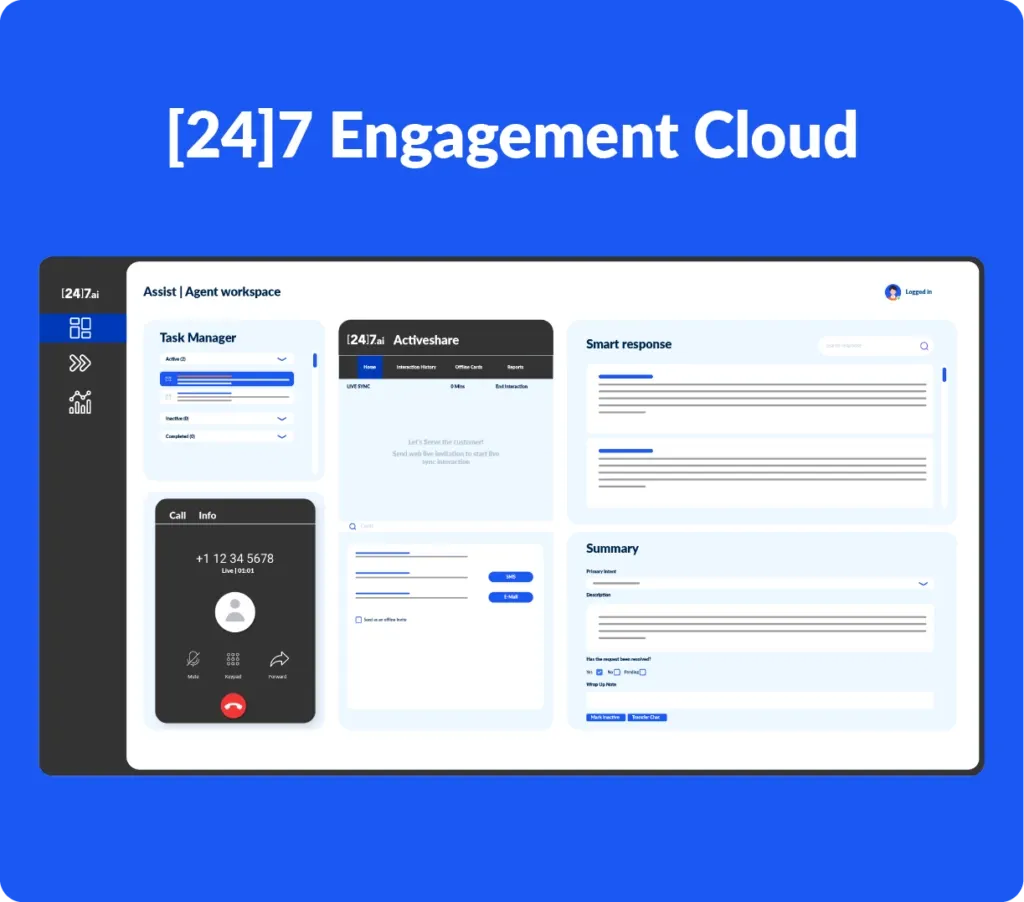

[24]7 Engagement Cloud, an AI-powered omnichannel CX platform, equips you to excel at every stage of the customer journey, from the very first interaction to building enduring relationships. A complete package that helps you acquire new customers, nurture existing ones, and drive long-term retention – all on a single, unified platform.

Discover how our platform empowers customers, agents and contact center leaders to deliver exceptional CX: - Services

Crafting Unforgettable Customer Experiences

Go beyond meeting expectations and cultivate customer loyalty. We are passionate CX specialists dedicated to crafting unforgettable experiences. Leverage a powerful blend of expertise, teamwork, and cutting-edge technology to transform your CX strategy. - Solutions

End-To-End CX Management

Explore by Use Case

US Retailer Transforms CX with [24]7.ai Managed Customer Engagement

Gold Awards at US Customer Experience Awards, 2024

- Company

Explore [24]7.ai

Explore Locations

- Insights

- Careers

Work @ [24]7.ai

Work Locations

- Product Login and Support

- Contact Us

AI in Insurance

Increase customer experience in the insurance industry with easy digital interactions powered by artificial intelligence, machine learning, and AI-powered chatbots.

Blend AI and Agents to enhance experiences and efficiency

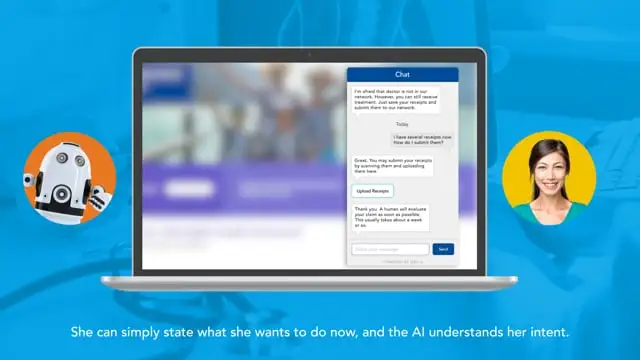

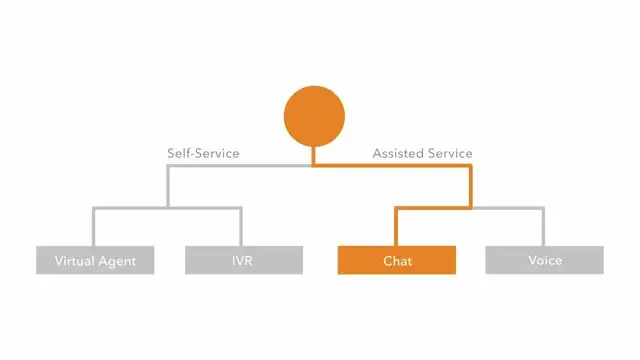

[24]7.ai redefines customer experience (CX) across every interaction. Our conversational AI platform lets you meet consumers where they are, anticipate their needs, and deliver exactly the right response. It is the only platform that predicts intent and resolves interactions consistently across time and channels.

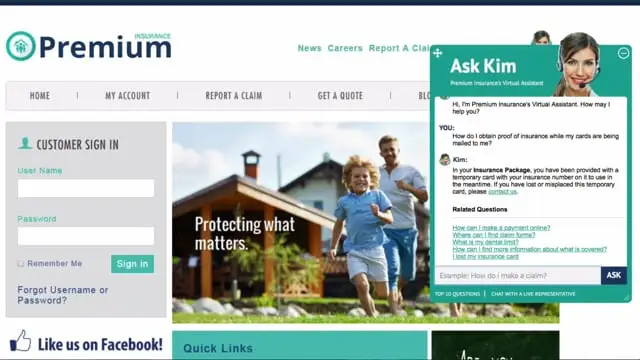

[24]7.ai digital-first solutions help improve customer experience by addressing insurance administration issues, claim filings, status checks, and even repair scheduling. Upgrade your CX by integrating insurance chatbots into digital and voice channels to enable self service, which seamlessly transitions to live agents at critical moments. Get started quickly with 200+ AI-powered prebuilt insurance intent models that simplify your insurance processes and deliver a personalized experience across all your customer touchpoints.

AI in insurance: transform your customer journey

Acquisition and Service

- New policy quotes

- Coverage renewals

- Welcome calls

- Servicing journey examples: reporting, filing and tracking claims, policy deductibles, proof of insurance

Retention and Loyalty

- Proactive reminders

- Regulation changes and policy implications

- Fast response times to account servicing

Customer Experience

- Predict service or sales intents across all channels

- Intervene in real-time to guide outcome

- Transfer context across channels for continuous experience

Maximize Profits

- Agent utilization and productivity

- Data and analytics

- Containment rates

- Technology and digital experiences

Chatbots in the insurance industry simplify the way customers do business with you

[24]7.ai chatbots discern intent, communicate in natural language, understand context, and sense emotional discomfort. Seamless interactions for insurance inquiries or transactions on any channel make for happy policy holders—and greater profits for you.

Best Practices

Embrace continuous improvement and adaptability as cornerstones of business success.

Best Practices

Embrace continuous improvement and adaptability as cornerstones of business success.

Best Practices

Embrace continuous improvement and adaptability as cornerstones of business success.

Operationalize Messaging

Messaging is profoundly changing the way consumers interact with businesses. Learn how [24]7.ai can help you improve customer satisfaction and strengthen loyalty by using conversational AI to make messaging a key part of your operation.

Best Practices

Embrace continuous improvement and adaptability as cornerstones of business success.

Hybrid Support

Our expertise and best-in-class hybrid work solutions ensure your business stays agile during crises, seasonal fluctuations, and unexpected events.

Best Practices

Embrace continuous improvement and adaptability as cornerstones of business success.

Operationalize Messaging

Messaging is profoundly changing the way consumers interact with businesses. Learn how [24]7.ai can help you improve customer satisfaction and strengthen loyalty by using conversational AI to make messaging a key part of your operation.

Hybrid Support

Our expertise and best-in-class hybrid work solutions ensure your business stays agile during crises, seasonal fluctuations, and unexpected events.

Choose a customer experience

Automation can support any type of insurance-related interaction

43% +

Containment rate

70%

Insurance service interactions solvable with automation

91%+

CSAT scores

2.4M+

Annual cost savings with a conversational AI solution

Explore our applications & technology

We’re committed to delivering real results. We launch and scale quickly and use data insights to identify opportunities for continuous improvement.