A noticeable gap now exists between the expectations of the increasingly impatient insurance consumer and the legacy insurance experience. Customers used to think that insurance journeys were slow, paper-heavy, and call driven, which led to delays in issue resolution and higher levels of aggravation. This model is not sustainable in today’s digital world. The rise of AI and automation is helping insurance customer experience become not only smarter and faster, but more self-service based while retaining the personal touch modern customers still require.

The Modern Insurance Customer Profile

Modern insurance consumers are digital-first, and they expect access to support and policy management when it is needed – 24/7. They place convenience as a priority, so they expect seamless engagement across mobile and omnichannel touchpoints, whether that’s an app, web portal, or messaging platform. Trust and transparency are important, too; while loyalty is based on past experience, trustworthy and transparent communication about claims, renewals, and policy changes is a meaningful interaction – and it can affect how they make decisions.

Pain Points in Today’s Insurance CX

- Lengthy claim processing delays drive 60% of dissatisfied customers to consider switching providers after a poor claims experience.

- Complex and confusing updates, jargon and unclear documents erode trust and spark more inquiries.

- Heavy reliance on human agents, even for your routine queries that increases operational costs and slows resolutions.

- Fragmented experiences such as disjointed digital journeys across websites, mobile apps, and call centers frustrate customers.

Smarter Self-Service with AI and Automation

| Claims Management |

|

| Policy Renewals and Updates/strong> |

|

| Customer Support Beyond Transactions |

|

The Human + AI Balance in Insurance CX

Empathy is still important, particularly with sensitive topics like suspected fraud or denied claims, or emotionally charged conversations. AI and automation enable live agents to put their focus on high-value situations, as opposed to wasting energy on repetitive tasks. By using AI for the speed and efficiency it provides, while still getting personalized support, insurers are enhancing trust and deeper relationships.

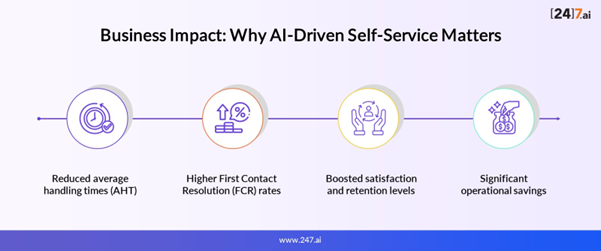

Business Impact: Why AI-Driven Self-Service Matters

- Reduced average handling times (AHT):AI chatbots and automation can cut manual effort by up to 80% in claims.

- Higher First Contact Resolution (FCR) rates:more queries are resolved in one interaction.

- Boosted satisfaction and retention levels: personalized, proactive service meets customer demand for transparency.

- Significant operational savings:from automation at scale, freeing up resources for strategic work.

Implementation Roadmap: Building Smarter Insurance CX

- Step 1: Audit the current customer journey to identify automation-ready pain points and opportunities.

- Step 2: Start with pilot projects such as automating claim status or policy updates to demonstrate value quickly.

- Step 3: Scale automation with omnichannel orchestration and advanced analytics, ensuring consistent experiences.

- Step 4: Upskill and train agents to complement automation, focusing on empathy and expertise in complex cases.

The Future of AI in Insurance CX

The future of Insurance CX involves the use of AI for predictive servicing – determining needs before the customer articulates them. Expect hyper-personalized policies, AI-driven recommendations, and rapid voice biometric verification soon. Also, typically seen in claims handling, creating a proactive system to significantly enhance risk management and claim prevention through integration with IoT, wearables, and smart devices will undoubtedly revolutionize CX in insurance.

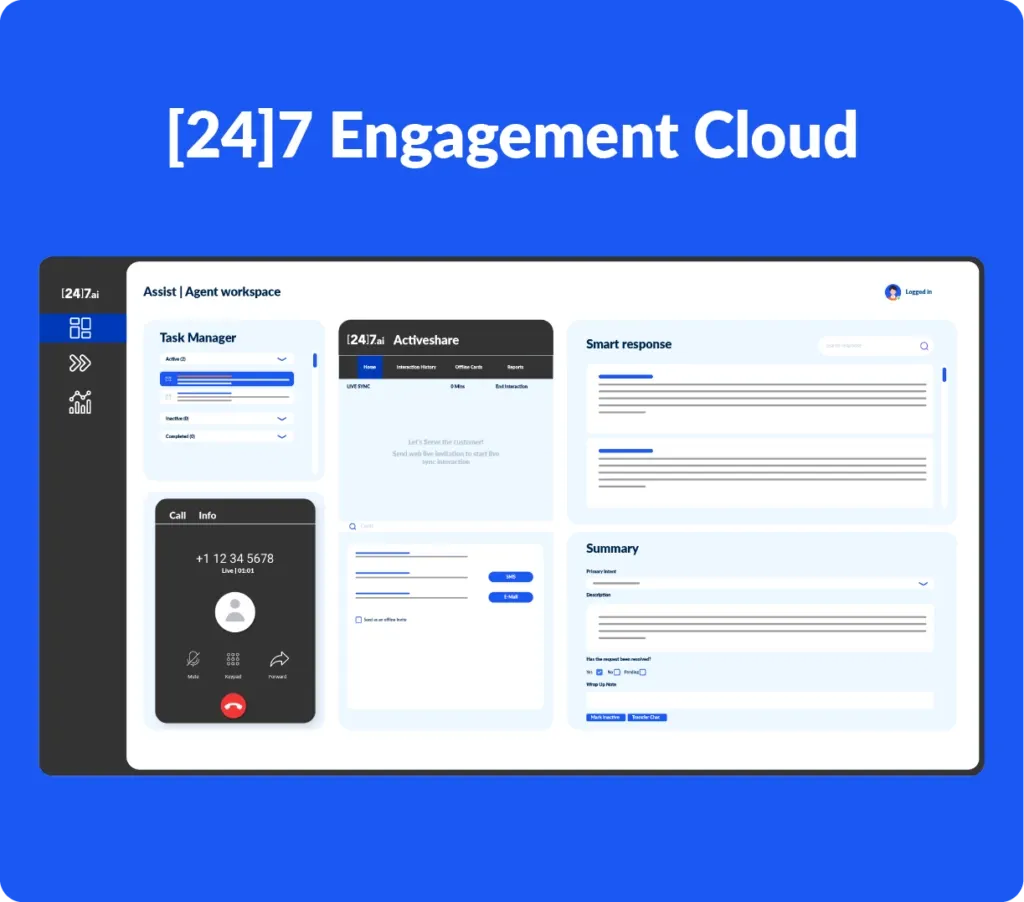

How [24]7.ai Helps Insurers Reimagine CX

[24]7.ai is transforming the insurance customer experience using conversational AI and digital-first solutions. This approach alleviates common pain points in claims, policy updates, and administrative tasks across every form of customer engagement. The platform does support transactional self-service needs via chat, voice, or social channels so customers can start, switch, and continue their journeys without friction, which facilitates lower engagement effort and greater retention.

Agent-assist AI supplies both suggestions and context in the moment, empowering insurance teams to more effectively, efficiently, and empathetically navigate complex queries. [24]7.ai has more than 200 full-service AI models tailored to the insurance space, digitally onboarding new policies, speeding up claims and policy updates, and personalizing every kind of engagement, which enhances customer satisfaction and retention. The integrated approach intertwines automation with people to provide prompt, efficient, tailored service in a scalable way.

Final Thoughts

Customers today expect insurers to deliver speed, convenience, and transparency. Hence, AI and automation are perfect for reshaping self-service, turning it from a cost-saving tool into a powerful driver of loyalty and satisfaction. The real opportunity lies in combining digital-first efficiency with a human, responsive touch. Insurers that partner with trusted players such as [24]7.ai will be best positioned to lead customer experience in the decade ahead.FAQs

Do AI chatbots have the capability to address complex claims?

AI chatbots can facilitate simple claims and provide updates on potential claims, while more complicated and emotional claims are quickly transferred to agents for emotional responses.

What cybersecurity measures are available for digital insurance transactions?

Some of the largest insurance companies are now using authentication, voice biometrics, and encrypted communications to secure a digital, insurance CX channel.

How quickly can an insurance company deploy self-service that is powered by AI?

Modularity enables insurers to launch pilots within a few weeks, while ensuring they proceed with a deliberate pace of growing their use cases to mitigate risk as they learn.

Will automation obviate the need for agents?

Automation allows agents to focus on high-value, empathy-based work, so it does not eliminate their roles.

What KPIs will improve after launching self-service that is AI-based?

Common KPIs that improve after launching AI based self-service agents include AHT, FCR, and NPS.