- Why [24]7.ai

- Products

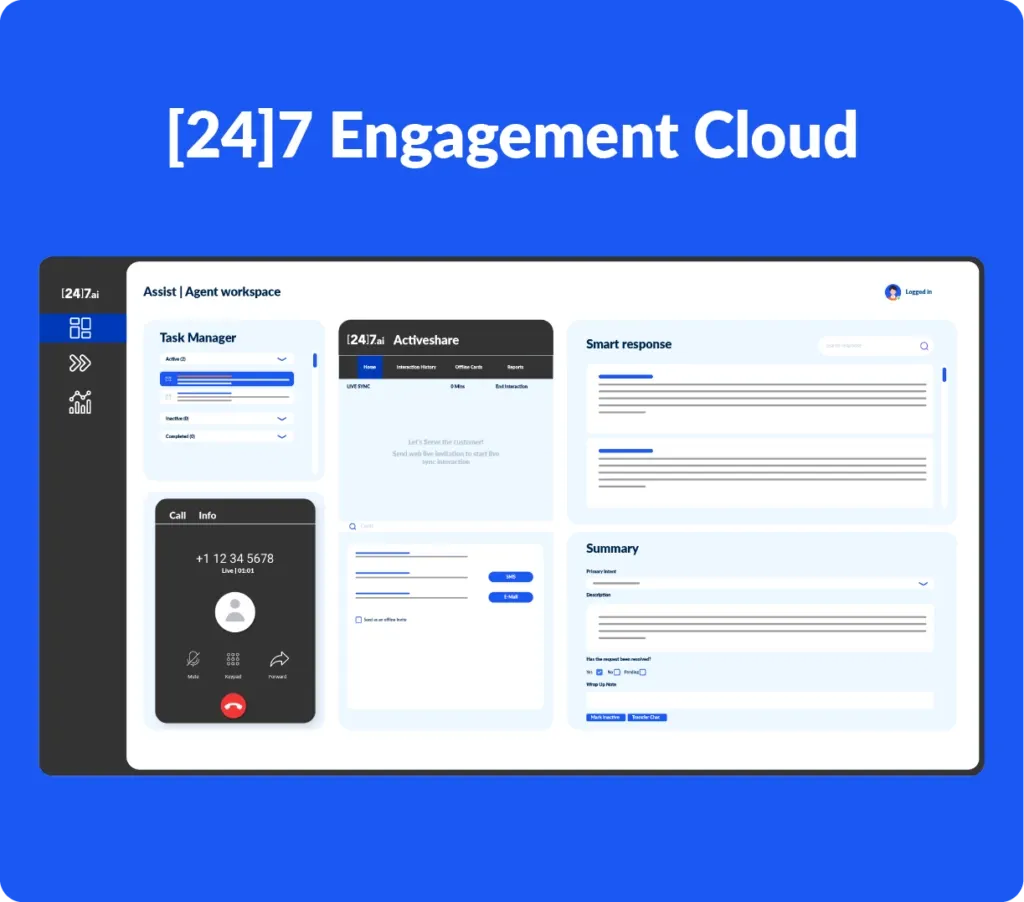

[24]7 Engagement Cloud, an AI-powered omnichannel CX platform, equips you to excel at every stage of the customer journey, from the very first interaction to building enduring relationships. A complete package that helps you acquire new customers, nurture existing ones, and drive long-term retention – all on a single, unified platform.Discover how our platform empowers customers, agents and contact center leaders to deliver exceptional CX:

[24]7 Engagement Cloud, an AI-powered omnichannel CX platform, equips you to excel at every stage of the customer journey, from the very first interaction to building enduring relationships. A complete package that helps you acquire new customers, nurture existing ones, and drive long-term retention – all on a single, unified platform.Discover how our platform empowers customers, agents and contact center leaders to deliver exceptional CX: - Services

Crafting Unforgettable Customer Experiences

Go beyond meeting expectations and cultivate customer loyalty. We are passionate CX specialists dedicated to crafting unforgettable experiences. Leverage a powerful blend of expertise, teamwork, and cutting-edge technology to transform your CX strategy. - Solutions

End-To-End CX Management

Explore by Use Case

US Retailer Transforms CX with [24]7.ai Managed Customer Engagement

Gold Awards at US Customer Experience Awards, 2024

- Company

Explore [24]7.ai

Explore Locations

- Insights

- Careers

Work @ [24]7.ai

Work Locations

- Product Login and Support

- Contact Us

Financial Services

Simplify digital banking for your customers and strengthen your bottom line with [24]7 conversational AI.

Predictive AI for building cutting-edge, self-service solutions for the financial industry

Predictive AI helped the global financial industry transform an operationally intensive service delivery model into one that is smart and built around self-service solutions. A higher share of AI-based, self-service solutions helps customers get tasks done without the rigors of navigating a manual process (translating to customer satisfaction). It also helps enterprises save on human capital, and therefore improve the bottom line.

The [24]7.ai customer engagement ecosystem ensures seamless integration, simple escalation, and effortless journeys, making it easy for banking customers to connect with financial service organizations. [24]7.ai’s Conversational AI includes 200+ prebuilt financial intent models that anticipate what customers want to get done and self-service technology that allows customers to resolve issues on their own. Customers can switch channels when desired without losing the context of the conversation.

Transform your customer journeys with AI

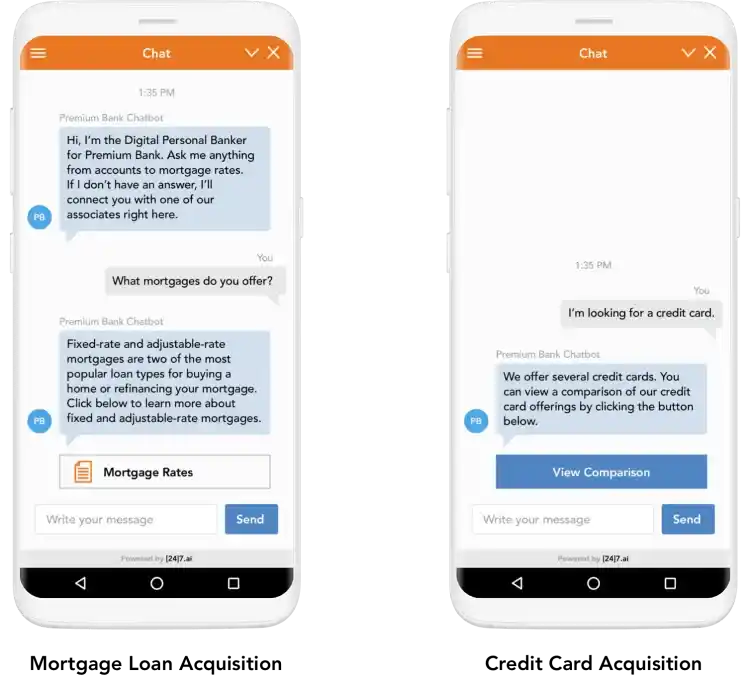

Customer Acquisition

- Product research

- Comparisons and recommendations

- Product upsell and cross-sell

- Apply for products and services

Activation

- Credit card activation

- Account onboarding

- Mortgage onboarding

- Investment onboarding

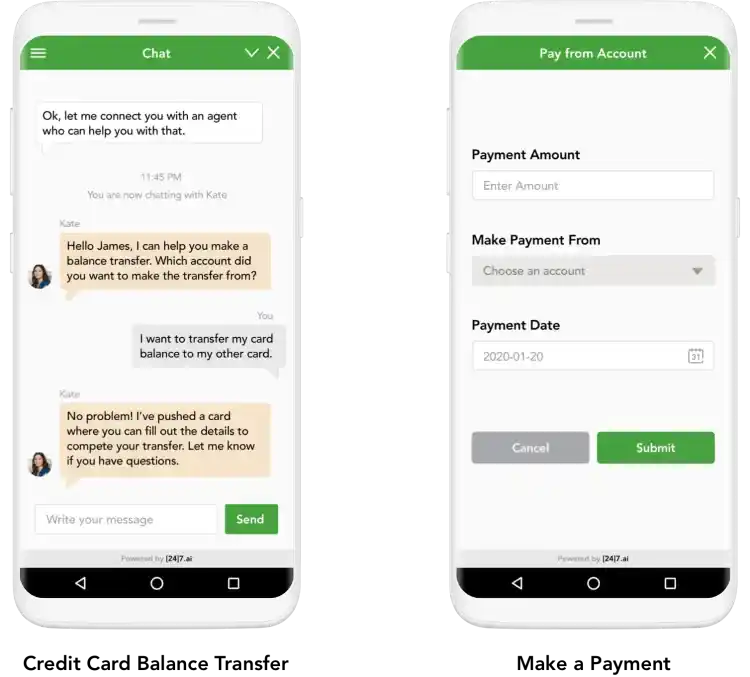

Servicing

- Authentication

- Account management

- On-demand banking

- Payments and transfers

- Fraud alert

- Charge verification

- Card unblock

Retention

- Financial advice

- Product advice

- Fraud prevention

- Loyalty programs

- Chatbot banking transactions

AI-based applications for financial customers

Valuable insights, featured stories, and material to help you drive success.

Self-service is a win-win

Your customers want to feel confident and in control. You want to free up your human agents to engage in complex customer inquiries. Chatbots and intelligent voice and digital automation tools easily handle basic queries such as “best type of account,” “best credit card,” and “best mortgage options” in the customers’ channel of choice, anytime and anywhere. They get quick and efficient answers. You get more satisfied customers and higher revenues.

Digital Activation and Onboarding

Consumers want to onboard and activate their services quickly. Proactively remind your new customer to activate with a text message. Once a user has logged in to their account, [24]7 AIVA artificial intelligence technology understands consumer intent and proactively provides a prompt for card activation, along with other services. This experience promotes digital adoption, deepens the relationship and drives cost savings.

Simplify Customer Journeys

Consumers want to complete their transactions seamlessly. Offer the right assistance at the right time and in real time across all channels and devices so your customers can manage routine inquiries with simple FAQ chatbots via [24]7 Answers or engage with more sophisticated AI-driven chatbots via [24]7 Conversations. Whether they’re looking to pay bills, check application status, stop payments, or any number of services provided, with [24]7.ai you make their journey more meaningful and convenient.

Digital Activation and Onboarding

[24]7.ai wants to ensure rewards, fraud prevention and complaint management programs are working for you. Security and fraud prevention are ongoing concerns for customers. With [24]7.ai solutions you can deploy proactive alerts on banking journeys, such as fraud alerts and charge verification for optimal protection. Customers can easily and visually confirm charges or be seamlessly connected to an agent with a few clicks.

Best Practices

Embrace continuous improvement and adaptability as cornerstones of business success.

Best Practices

Embrace continuous improvement and adaptability as cornerstones of business success.

Best Practices

Embrace continuous improvement and adaptability as cornerstones of business success.

Operationalize Messaging

Messaging is profoundly changing the way consumers interact with businesses. Learn how [24]7.ai can help you improve customer satisfaction and strengthen loyalty by using conversational AI to make messaging a key part of your operation.

Best Practices

Embrace continuous improvement and adaptability as cornerstones of business success.

Hybrid Support

Our expertise and best-in-class hybrid work solutions ensure your business stays agile during crises, seasonal fluctuations, and unexpected events.

Best Practices

Embrace continuous improvement and adaptability as cornerstones of business success.

Operationalize Messaging

Messaging is profoundly changing the way consumers interact with businesses. Learn how [24]7.ai can help you improve customer satisfaction and strengthen loyalty by using conversational AI to make messaging a key part of your operation.

Hybrid Support

Our expertise and best-in-class hybrid work solutions ensure your business stays agile during crises, seasonal fluctuations, and unexpected events.

[24]7.ai is the right choice for financial services

Improve customer NPS and CSAT

A Multinational Financial Services Corporation

After the corporation introduced a [24]7.ai conversational AI solution, 95% of users rated their experience a 4 or 5 on a scale of 1 to 5. Their charge verification solution received the Chairman’s Award for mobile innovation.

Use chatbots to increase self-service and lower average handle times

Large Canadian Chartered Bank

One of Canada’s largest chartered banks introduced an intelligent chatbot (virtual agent) and saw email volume immediately decrease by 50% and then drop another 23% throughout the first year. Phone calls decreased by 25%.

Our financial services solutions can handle a great volume of interactions with high success

91%

CSAT scores

1.6M+

Chat interactions/year

2.4M+

Overall cost savings/year

17%

Increase in program enrollment to payback collectible debt

Resources

Stories that inspire us to do more

Valuable insights, featured stories, and material to help you drive success.

Explore our applications & technology

We’re committed to delivering real results. We launch and scale quickly and use data insights to identify opportunities for continuous improvement.