Fraud in banking is rising at an alarming rate. According to a study by Juniper Research, global merchant losses from online payment fraud are projected to exceed $343 billion between 2023 and 2027. Banks and financial institutions must strengthen fraud protection while keeping the customer experience smooth and trustworthy.

Traditionally, security meant long authentication processes, repeated PINs, and passwords that slowed down interactions and frustrated customers. However, a new standard is emerging. By blending voice biometrics, AI-powered detection, and human empathy, banks can achieve both ironclad fraud prevention and effortless customer experience.

The Limitations of Traditional Fraud Prevention

For decades, fraud prevention relied on knowledge-based authentication (KBAs), such as PINs, passwords, and security questions. While once effective, these methods are no longer sufficient:

- Easily compromised: Data breaches and phishing make KBAs vulnerable.

- Cumbersome for customers: Repeated checks add friction, leading to frustration.

- Costly for banks: Longer average handling times (AHT) increase operational expenses.

The result is a model that struggles to keep up with sophisticated fraud schemes while eroding customer trust and loyalty.

Voice Biometrics: The New First Line of Defense

Voice biometrics offers a more secure and seamless way to authenticate customers. By analyzing over 1,000 unique voice characteristics, it creates a unique voiceprint that is nearly impossible to replicate.

- How it works: Authentication can be passive (verified during conversation) or active (customers speak a passphrase).

- Advantages: Faster verification, stronger fraud resistance, and a smoother customer experience.

- Use cases: High-risk transactions, collections, and account servicing benefit most from voice biometrics, reducing fraud attempts without slowing down interactions.

This technology shifts authentication from a painful step to an invisible layer of trust.

AI-Powered Fraud Detection and Prevention

AI adds a second layer of defense by spotting anomalies human agents might miss.

- Real-time anomaly detection: AI analyzes call behaviors and transaction patterns to flag suspicious activity instantly.

- Predictive analytics: Historical and behavioral data help forecast fraud attempts before they happen.

- Integration with biometrics: Voice verification combined with AI models creates a multi-layered shield that is both more accurate and adaptive.

This technology shifts authentication from a painful step to an invisible layer of trust.

The Human Factor: Why Empathy Still Matters

Fraud is not only a financial issue but also an emotional one. Customers impacted by fraud often feel fear, frustration, or even shame. How banks handle these moments defines long-term trust.

- Role of agents: Customers want reassurance, clear guidance, and a human touch.

- Agent enablement: With AI-driven insights, agents can focus on empathy, addressing customer concerns while AI handles the heavy lifting of detection and verification.

This combination ensures customers feel protected, not interrogated.

The Contact Center Advantage: Where Technology and Empathy Converge

Modern BPOs and contact centers have become innovation centers for fraud defense. They sit at the intersection of technology and human interaction, making them critical in operationalizing fraud prevention strategies.

[24]7.ai helps banks deploy voice biometrics and AI at scale, ensuring every interaction is both secure and seamless. Through training and culture, contact centers embed empathy as a core differentiator, ensuring agents handle fraud-related conversations with sensitivity.

The result is stronger fraud protection while maintaining a seamless customer experience.

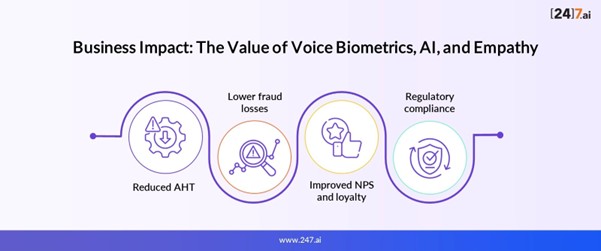

Business Impact: Why This Model Works

The combined model of voice biometrics, AI, and empathy delivers tangible business results:

- Reduced AH: Faster authentication cuts call times, improving efficiency.

- Lower fraud losses: Proactive detection reduces exposure to fraud attempts.

- Improved NPS and loyalty: Customers stay with banks that make them feel safe and valued.

- Regulatory compliance: Contact centers enable banks to maintain compliance in a complex regulatory environment.

Therefore, security is no longer a trade-off for experience and now drives customer loyalty.

The Future of Fraud Prevention in Banking Contact Centers

Fraud tactics evolve constantly, which means defenses must too. Emerging innovations are shaping the future of fraud prevention:

- Continuous authentication: Verifying identities throughout the interaction, not just at the start.

- Behavioral biometrics: Tracking typing speed, device use, and interaction style for added layers of security.

- Emotion AI: Detecting stress or deception in voice to flag potential fraud attempts.

Forward-thinking banks are already investing in infrastructure, data readiness, and agent training to prepare for this future. This results in fraud prevention that is predictive, adaptive, and customer-first.

How [24]7.ai Helps Banks and Insurance Companies Strengthen Fraud Defense

[24]7.ai enables banks to accelerate their fraud prevention journey by uniting AI, voice biometrics, and empathy. Voice biometrics integrated with AI deliver faster and more secure authentication. Agent-assist tools combine AI-driven insights with human empathy for sensitive conversations.

This approach drives proven outcomes, including reduced fraud, faster resolution, and stronger customer trust.

Final Thoughts:

Security and experience no longer have to compete. With voice biometrics, AI, and empathy working together, banks can prevent fraud effectively while keeping the customer journey seamless.

Partnering with [24]7.ai helps accelerate this transformation, delivering stronger protection and enhanced trust at every interaction.

Get started by contacting us today!

FAQs

Why is voice biometrics becoming essential for banks?

Modern voice biometric systems can achieve accuracy rates above 90%, especially when combined with AI-driven verification.

Can fraudsters spoof a customer’s voice using AI deepfakes?

Advanced solutions use liveness detection to spot synthetic or recorded voices, minimizing the risk of deepfake-based fraud.

Does using voice biometrics slow down customer service?

No. In fact, it significantly reduces handling times since verification happens passively during conversations.

How do AI and empathy work together in fraud prevention?

AI handles detection and verification in real time, freeing agents to focus on empathy by reassuring customers and guiding them through resolution.

How can banks enhance fraud prevention without compromising customer experience?

Scaling fraud prevention requires both advanced technology and operational expertise, something [24]7.ai brings with proven results across banking clients.