Banking has always been built on trust. Yet today, trust alone isn’t enough; customers expect confidence, speed, and personalization in every interaction. For banks, that means the quality of customer experience (CX) determines loyalty, revenue, and reputation. In 2024, CX quality in banking slipped across major markets: falling for the third consecutive year in the U.S., hitting an all-time low in Australia, and dropping sharply across the EU. As CX quality declines, so does customer loyalty.

This challenge, however, opens a powerful opportunity. By blending AI’s scale and intelligence with the empathy and judgment of human expertise, banks can reimagine customer engagement. They can accelerate onboarding, simplify service, strengthen fraud prevention, and guide customers toward financial wellness.

From Broken Journeys to Value-Creating Moments

Traditional banking journeys often feel clunky: onboarding drags out with endless document checks, fraud alerts create frustration, and product communications are opaque. Most CX initiatives stop at fixing what’s broken. But customers aren’t just looking for efficiency; they want to feel respected, valued, and supported. Research shows that emotions such as confidence and trust drive loyalty more than ease or effectiveness alone.

This is where AI, combined with empowered human agents, creates value beyond efficiency. AI handles the heavy lifting of analysis, pattern recognition, and predictive decisioning, while human agents deliver empathy and reassurance.

Smart Use Cases Driving Differentiation

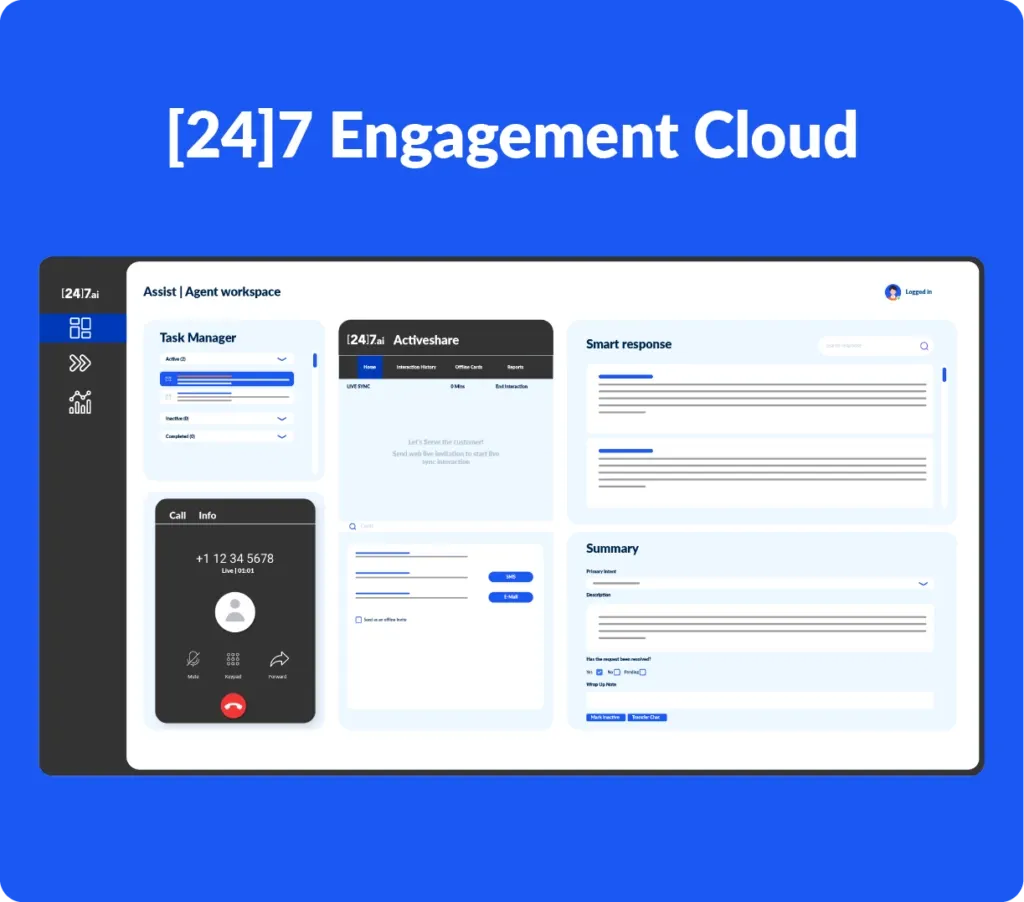

- Frictionless Onboarding: AI-powered ID verification and document processing reduce delays, while video chat and co-browsing let agents guide customers in real time through application forms – ensuring smarter self-service, and speed without sacrificing assurance.

- Fraud Prevention with Confidence: Instead of confusing “false positive” fraud alerts, AI models now detect anomalies with greater accuracy. When human agents step in, they can explain decisions transparently, reassuring customers while maintaining vigilance.

- Handling Complex Banking Needs: Secure video calls allow customers to connect directly with virtual bankers to resolve complex issues that would otherwise require a branch visit. From mortgage applications and loan restructuring to high-value transactions, video chat delivers the convenience of digital with the reassurance of face-to-face interaction—building trust while saving time.

- Receiving Banking Offers That Actually Matter: AI analyzes customer behavior and financial patterns to deliver tailored product offers or nudges for savings and investments. This builds trust by showing the bank understands and anticipates customer needs. Forbes recently pointed out how AI enables “just-in-time marketing efforts” based on life events and transaction behavior to drive cross-sell and upsell

- Continuing a Conversation Across Any Channel: Customers expect continuity whether they start on mobile, call a service line, or walk into a branch. AI-powered orchestration ensures conversations flow seamlessly across channels, while human agents step in when empathy or negotiation is required.

- Making Secure Payments During a Call: Innovations like active cards let a customer calling into a contact center complete a transaction securely on a mobile interface—bridging voice, digital, and human support in one fluid experience.

Designing Scalable, Trust-Driven Experiences

Scaling these innovations isn’t easy. Legacy infrastructure and regulatory complexity remain roadblocks. But leading banks are proving it’s possible by rethinking both technology and culture.

- AI-first vision, human-led execution:Banks that see AI as more than cost-cutting invest in AI agents, predictive models, and automation that enhance, not replace, human capabilities. Agents are trained to interpret, empathize, and build relationships. A recent survey shows 89% of banking executives now cite security and fraud prevention as a priority, and many are using AI copilots to enhance digital CX.

- Cross-functional orchestration: Successful banks don’t launch chatbots or tools in isolation. They redesign entire domains end-to-end, from onboarding, and servicing, to lending – with AI + human workflows, ensuring consistency and scalability.

- Continuous training for people:Exceptional experiences still depend on exceptional people. Training frontline staff to use AI insights and adapt empathetically to customer signals creates an edge competitors can’t easily replicate.

- Zero-based design: Instead of layering fixes on broken journeys, forward-looking banks “clean sheet” the customer journey—co-creating with customers and borrowing inspiration from retail, travel, and tech to design experiences that feel effortless.

Why Is This Important Now?

The link between CX and revenue is undeniable. A single-point increase in CX scores can unlock more than $100 million in incremental revenue for large banks. And satisfied customers are more likely to remain loyal and purchase additional products. In a market where interest rates are volatile, competition is rising from fintechs and neobanks, and customer trust is fragile, the ability to deliver differentiated experiences is a survival strategy.

CX as the New Growth Engine

The next wave of banking CX is all about mastering the balance between automation and human connection. AI provides the scale, intelligence, and personalization customers demand. Humans deliver the empathy, reassurance, and trust. Together, they’re reshaping banking from the inside out.

For BFSI leaders, the question is how fast they can scale to meet rising customer expectations. With determination, strategic thinking, and investments in next-generation digital platforms, banks can overcome these obstacles and create a truly customer-centric future. As Forrester notes, “Improving CX goes straight to the bottom line” – the institutions that act boldly now won’t just modernize operations; they will set the standard for trust-driven, innovation-led growth in financial services.