With more than 60 percent of contact center fraud cases originating in the IVR [1], preventing fraud over the voice channel remains top of mind for CX leaders. TransUnion notes that identity fraud instances have been on a continuous rise, with fraud in call centers jumping by 350 percent between 2013 and 2019 [2]. And for financial services organizations, identity theft is reported as the top fraud type, having increased 23 percent since the start of the pandemic [2].

Taking the right steps to verify customers and safeguard sensitive customer data is more critical than ever. Companies that design secure customer journeys see not just an increase in customer trust and confidence, but also a boost to their bottom lines. Experian notes that 74 percent of customers consider security the most critical factor when deciding to engage with a business.

Companies have traditionally relied on PINs, passwords, and knowledgebase (KB) security questions to authenticate customers. KB questions include answers to secret questions such as "What is your favorite food?" or "Who was your first-grade teacher?"

Fraudsters are increasingly exploiting the vulnerabilities of weak passwords and KB questions that are easily guessed. So to increase their security posture, companies often ask customers for additional personal identification.

This frustrates customers by adding steps when all they want is a fast and seamless path to resolution, and burdens them with remembering and manage passwords and PINs. When customers hear, “For any transactions, please keep your account, card, and telephone PIN ready,” they often either abandon the call (only to reach out later when they have the information) or skip self-service entirely and ask for an agent. Both cases increase the contact center’s operational costs.

Additionally, authentication methods that use Personally Identifiable Information (PII) increase the risk of exposing sensitive data in a breach.

Human voices, like fingerprints, contain characteristics unique to each individual—that’s why voiceprint technology identifies speakers with a very high degree of accuracy, enabling brands to provide stronger authentication within a more frictionless customer experience. In fact, 77 percent of customers say they feel most secure when using physical biometrics, and 62 percent of customers say it improves their experience when managing finances or payments online [3].

Depending on the use case and level of transaction risk, voice biometrics can either replace or be combined with traditional security methods such as PINs and passwords. High-risk transactions requiring multifactor authentication can combine voiceprints with sensitive customer information.

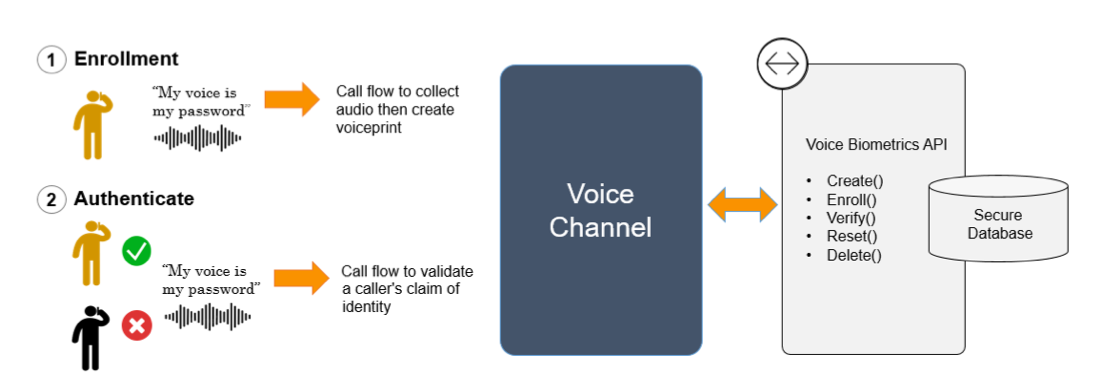

Voice biometrics authentication is a two-step process.

First is speaker enrollment or recognition: The customer registers their voiceprint. The voice biometric engine verifies and identifies the speaker’s voice by its unique voice characteristics and creates a unique enrollment profile.

Next is speaker authentication or verification: When enrolled customers call, they are asked to repeat a random set of words, or a passphrase chosen from a predefined set, to give the voice biometric engine plenty of information to use during authentication. The individual’s voice is then compared to the enrolled voiceprint and verified.

As noted above, the speaker authentication process uses either a passphrase or freeform voice input.

When speakers choose the same passphrase for both enrollment and verification phases, it’s called active or text-dependent voice biometrics. The speaker's voice is compared to the voice signature and the passphrase together to verify the speaker every time.

When speakers use everyday language in the enrollment and verification phrases, it’s called passive or text-independent voice biometrics. Text-independent verification places no restrictions on what the speaker says during enrollment or in the audio sample to be verified; it only extracts voice features to score similarity.

The modern voice biometrics solution is a powerful authentication tool for voice self-service journeys. The key benefits for contact centers include:

Speaker Verification for [24]7 Voices™ leverages Microsoft’s state-of-the-art speech technology, the Speech service, which is part of Microsoft Azure Cognitive Services. The Speech service unifies speech-to-text, text-to-speech, and speech-translation into a single Azure subscription; it includes enterprise-grade security, availability, compliance, and manageability, and is certified by SOC, FedRamp, PCI, HIPAA, HITECH, and ISO.

[24]7.ai utilizes industry and domain expertise to further enhance the Speaker Verification ecosystem. We provide an application processing framework, enabling accept/reject logic in the context of the application and use case. With application design, we provide templates and use cases for wide-ranging security requirements and ensure optimal security performance. We also provide comprehensive reporting that enables you to gain insights into the authentication success rate and causes of failure.

[24]7 Voices brings your IVR experience into the modern era by enabling you to automate and personalize complex conversations, predict user intent, and integrate seamlessly with other voice channels [24]7 Voices is a key component of our unified, enterprise-scale voice and digital platform, [24]7.ai Engagement Cloud, which has everything you need for unparalleled customer engagement.

Whether you’re looking to upgrade your existing IVR system or augment it with [24]7 Voices powered by the AIVA engine, [24]7.ai has a framework to match your needs—today and tomorrow. We’re the partner you can rely on to outperform your goals.

To learn more about how modern IVR increases self-service containment and elevates CX:

Or email us or visit our Contact Us page.

[1] https://www.bankinfosecurity.com/whitepapers/fraudsters-journey-fraud-in-ivr-w-6896#dynamic-popup